Damage to property and possessions from flooding can cost you thousands (and thousands) of dollars. For a rough estimate, check out FEMA’s Flood Smart cost of flooding tool.

Fortunately, you can help protect against financial loss from flooding with good insurance coverage. But not all insurance coverage is alike, so you’ll want to understand the fine print. Here are a few questions to ask your flood insurance provider:

What’s covered and what’s not?

Most policies cover building property and personal contents, but most don’t cover property outside of the insured building. These means you’ll need separate coverage for your deck, barbeque, swimming pool or car. In addition, most policies don’t cover living expenses should you evacuate.

How much coverage do I need?

People tend to underestimate the value of their possessions. You’ll want enough coverage to mitigate your losses. It’s worth taking a careful tally of what you own.

Also, some policies provide replacement cost value while others provide actual cash value for damage items. Make sure you (and your insurance agent) understand the difference.

Do I live in a flood zone? What’s the flood risk?

You can use FEMA’s Map Service Center for preliminary research on your flood risk. Keep in mind, however, flooding doesn’t just occur from tropical storms or heavy rain. Your basement can just as easily flood from snow melt or the construction site next door.

Who do I call?

Make sure you know who to call to make your insurance claim. It will be much harder to track down contacts or information in the midst of a disaster.

How can I lower my premiums?

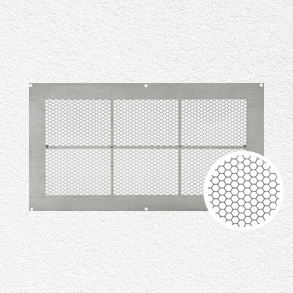

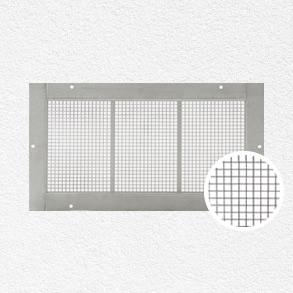

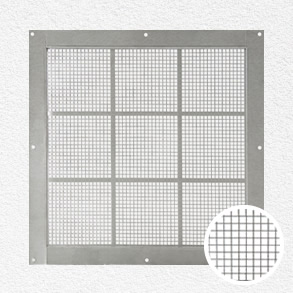

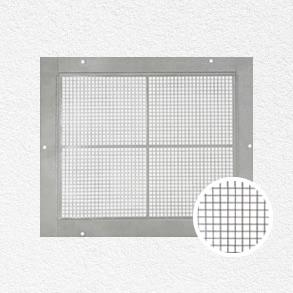

Some insurance providers charge lower premiums to homeowners who take steps to mitigate flood damage. For example, by installing flood vents from Flood Solutions, you may be eligible for reduced insurance premiums.

Check out FEMA’s Flood Smart website for a complete list of questions to ask your insurance agent. Contact Flood Solutions for more information about how flood vents can lower your insurance costs.