FEMA is in the process of updating the nation’s flood maps. They use statistical data on river levels, rainfall and other factors to assess flood risk and then communicate these findings through flood hazard maps. These maps largely determine how much you’ll pay in flood insurance premiums. If your area’s assessment changes from low to high risk, your premiums will likely go up.

There is a way to avoid this premium increase, at least for a while. As described in a National Flood Insurance Program fact sheet, property owners can grandfather their existing flood insurance policy if they renew and maintain coverage before the new maps are released. Grandfathering is also available to property owners who built their homes in compliance with the flood map in effect at time of construction. Keep in mind, though, if your risk assessment level decreases, your new premium could go down, not up. Consult with your insurance agent to determine the best strategy for you and your home.

In the meantime, to keep up to date on FEMA’s flood map changes, check out “What’s New in Flood Hazard Mapping.” You can also sign up for FEMA email updates.

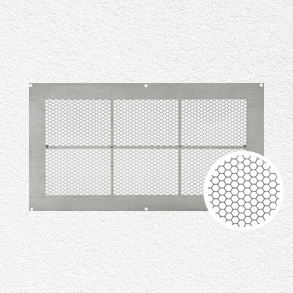

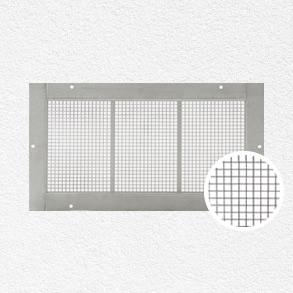

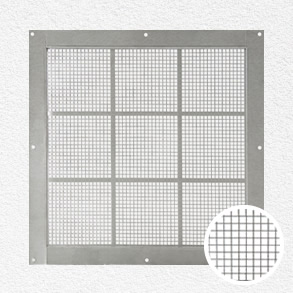

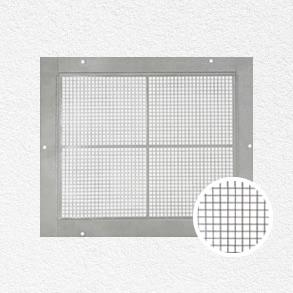

And while you’re looking for ways to lower your flood insurance premiums, ask your insurance agent about premium reductions for flood vents. Flood vents often qualify you for a lower rate.

All our Flood Solutions flood vents are FEMA compliant and made of heavy-duty construction. They’re guaranteed not to rust or rot. For more information, contact us.