In a recent FEMA-commissioned report, The Impact of Climate Change and Population Growth on the National Flood Insurance Program, researchers predict a significant increase in coastal and riverine flooding over the next 90 years. They estimate that flood hazard areas could grow 40-45% by the year 2100 as a result of population growth (which puts more people into flood hazard areas) and climate change (which increases the size of flood hazard areas).

Naturally, these changes bring higher flood insurance costs. In fact, if shorelines remain unchanged, the report writers estimate that the average loss per policy could increase 90% by 2100. Given these numbers, it’s not surprising that the Biggert-Waters Act was introduced as a way to control these costs.

While debate over Bigger-Waters continues, some observers are asking why taxpayers are subsidizing the cost of insuring a smaller group of homeowners. As the Washington Post editorial board recently stated:

… it takes some chutzpah for NFIP beneficiaries to act entitled to subsidies from the vast majority of taxpayers who chose not to live on the beach — or who never could afford it in the first place.

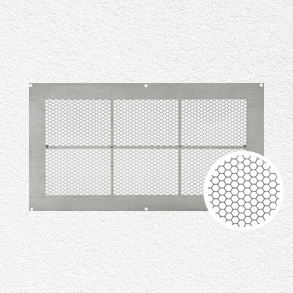

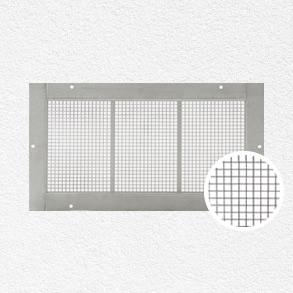

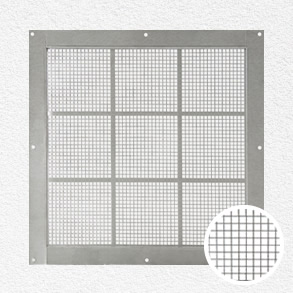

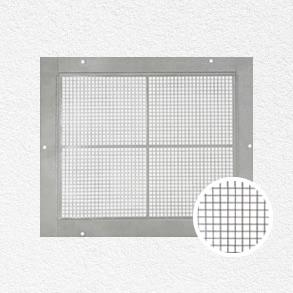

While we’ll leave this debate to lawmakers, it’s worth pointing out that one of the easiest and least expensive ways to mitigate flood damage to your home is to install flood vents. Our FEMA compliant flood vents help keep the integrity of your home’s foundation intact—whether you live on the beach or not. To learn more about our flood vents, contact us.