The debate over what to do about the rising cost of national flood insurance continues. At the end of January, the Senate passed a bill to delay Biggert-Waters implementation by four years in response to many homeowner complaints about dramatic increases in flood insurance premiums.

More recently, on February 21, House GOP leaders introduced legislation that would reinstate insurance rate subsidies for homes located in flood prone areas and keep these subsidies in place even when the house is sold. Instead, the bill will allow FEMA to slowly raise insurance premium rates over a longer period of time.

Whether these latest amendments to Biggert-Waters will actually pass through Congress remains to be seen. Nonetheless, it’s clear that the debate over Biggert-Waters, and climbing insurance costs generally, is far from over. And if you’re a homeowner who needs flood insurance, you can bet on your rates going up, either now or later.

Fortunately, you can take steps to reduce your flood insurance premiums regardless of how the legislation develops. The NFIP (National Flood Insurance Program) gives homeowners a break on insurance premiums when they implement improvements to mitigate flood damage, such as elevating homes and installing flood vents.

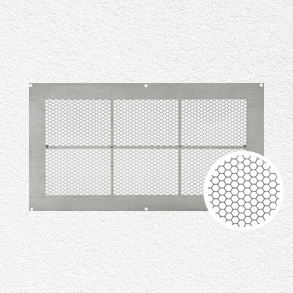

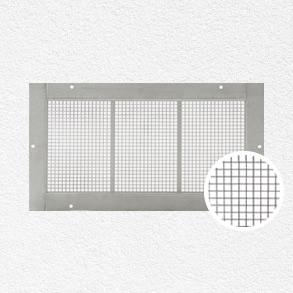

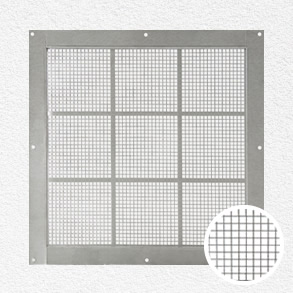

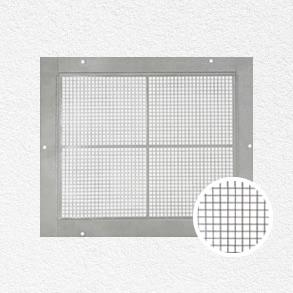

Flood Solutions flood vents are FEMA compliant and come in a variety of sizes and models. They’re made of heavy-duty aluminum and start at only $52.00. Learn more about FEMA/NFIP flood vent requirements or contact us with your questions.