On July 6, 2012, the Biggert-Waters Flood Insurance Reform Act came into effect. The purpose of the law is to bring the National Flood Insurance Program out of its financial deficit by phasing out subsidies and updating flood zone maps. If you’ve seen an increase in your flood insurance rate this year, this law might be the reason why.

Rates for subsidized non-primary residences increased 25 percent on January 1st of this year. Increases for additional categories of subsidized properties will continue through 2013. Starting in 2014, premium rates for non-subsidized properties may also increase as new or revised flood insurance rate maps come into effect.

While no one enjoys paying for flood insurance, your mortgage lender may require it and, in many cases, it’s just the right thing to do. So what can you do to lower your premiums? Premiums are based on an assessment of your home’s flood risk; if you can reduce your risk, you might get a break on premiums.

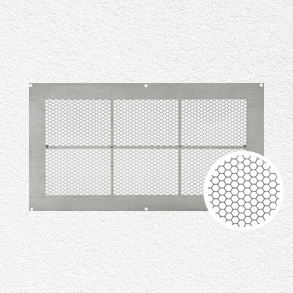

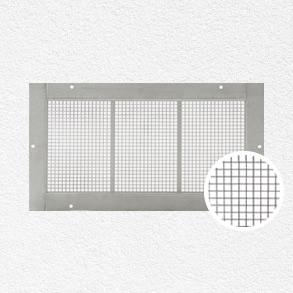

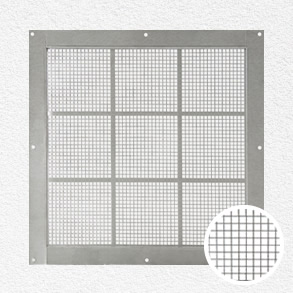

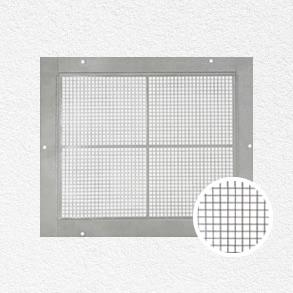

Big-ticket upgrades, such as relocating your home or raising it above minimum elevation standards, can lower your flood insurance rates. If you’re not prepared to make that kind of investment, you can still make less pricey upgrades to reduce your premiums, such as adding flood vents to enclosures.

At Flood Solutions, we manufacturer FEMA compliant flood vents for homes and commercial properties. Our flood vents are priced from $52.00 to $119.00, making them an affordable way to mitigate flood damage and reduce your flood insurance costs. For more information about our flood vents, contact us.